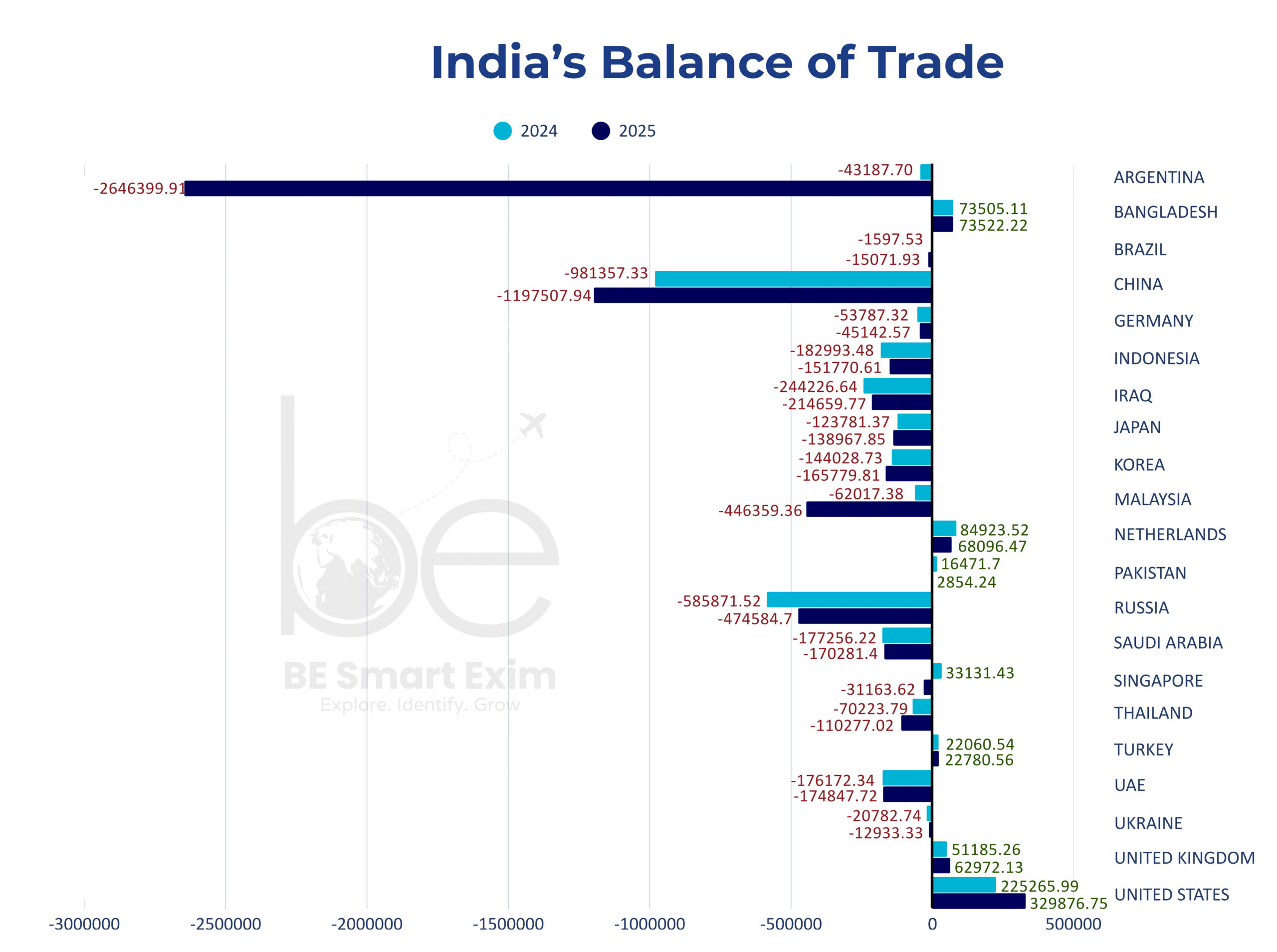

India’s Trade Balance Across Major Partners: A Snapshot

The trading balance for India from 2025 for its main trading nations demonstrates an increase in divergences. This has resulted from import-driven sectors on one side and export-driven sectors on the other. As evident from the attached charts, the total imports from the selected nations for India in 2025 were approximately ₹76.5 lakh crores, while the total exports from India to these nations for the said year aggregated around ₹22.2 lakh crores.

These statistics demonstrate the importance of looking beyond the aggregation and examining the dynamics for the trading partner.

Trade Deficits: Where Dependence Is Highest and What It Enables

From the following data, it is clear that the largest trade deficits in the year 2025 for the Indian economy exist in a few countries. China has registered a trade deficit of about ₹11.98 lakh crores, as the import value has moved up to ₹13.54 lakh crores from the previous value of ₹11.08 lakh crores in the year 2024, and the export value has also improved to ₹1.57 lakh crores.

A similar trend is observed in Russia’s imports of ₹5.18 lakh crore and exports of merely ₹43,082 crore, which lead to deficits of ₹4.75 lakh crore. Although it is slightly less than in 2024, deficits in Saudi Arabia at ₹1.70 lakh crore and Iraq at ₹2.15 lakh crore pertain primarily to oil.

A drastic change is noticed in Argentina, which imported an amount of ₹2.65 lakh crore in 2025 compared to ₹51,600 crore in 2024, with export values less than ₹10,000 crore, thus registering a deficit exceeding ₹2.64 lakh crore. This clearly shows the abrupt rise in the import of commodities without any substantial export background.

While these deficits reflect vulnerability, they also signal sustained domestic demand and industrial activity. High import volumes support manufacturing, infrastructure, and energy security, while simultaneously highlighting areas where India is incentivised to pursue import substitution, supplier diversification, and domestic capacity expansion.

Trade Surpluses: Markets Where India’s Exports Are Winning

Conversely, the graphs depicting the surplus markets identify the respective sectors in which the Indian exports display the most competitiveness. The United States is still the main partner country for the Indian surplus, with the value for Indian exports amounting to ₹7.42 lakh crore in the year 2025, as against the import value of ₹4.82 lakh crore, creating a balance in the amount of around ₹3.30 lakh crore, which escalated by an amount of ₹2.25 lakh crore in the year 2024.

It also had favourable balances with the United Kingdom, as its exports worth ₹1.24 lakh crore exceeded its imports worth ₹60,885 crore by a surplus of almost ₹62,972 crore. Bangladesh is still a constant surplus supplier, as it exported products worth ₹90,302 crore compared to ₹16,780 crore imported from it, maintaining a surplus amount of over ₹73,500 crore.

The smaller, though significant, surpluses are seen in the case of the Netherlands, Turkey, and Pakistan, adding to India’s position of strength in the region and European markets. The figures of surpluses from these countries reflect the fact that the growth of Indian exports is increasingly being supplemented and driven by manufactured goods.

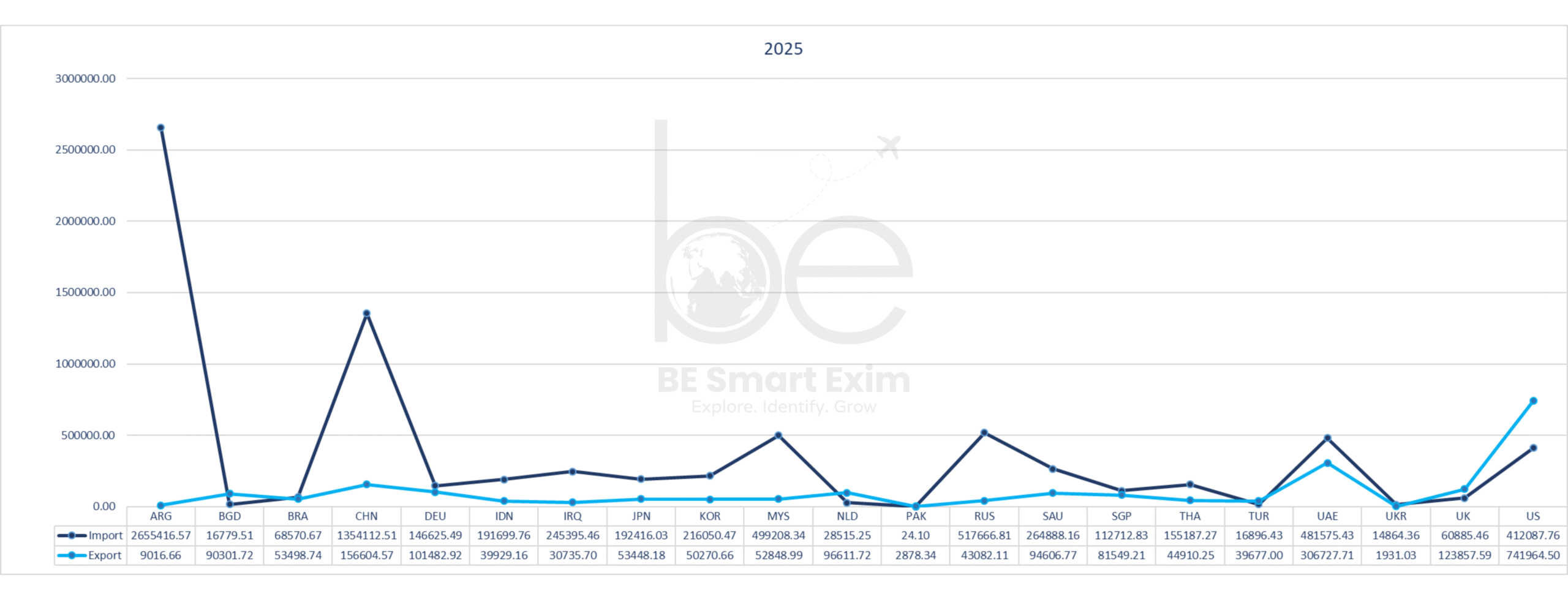

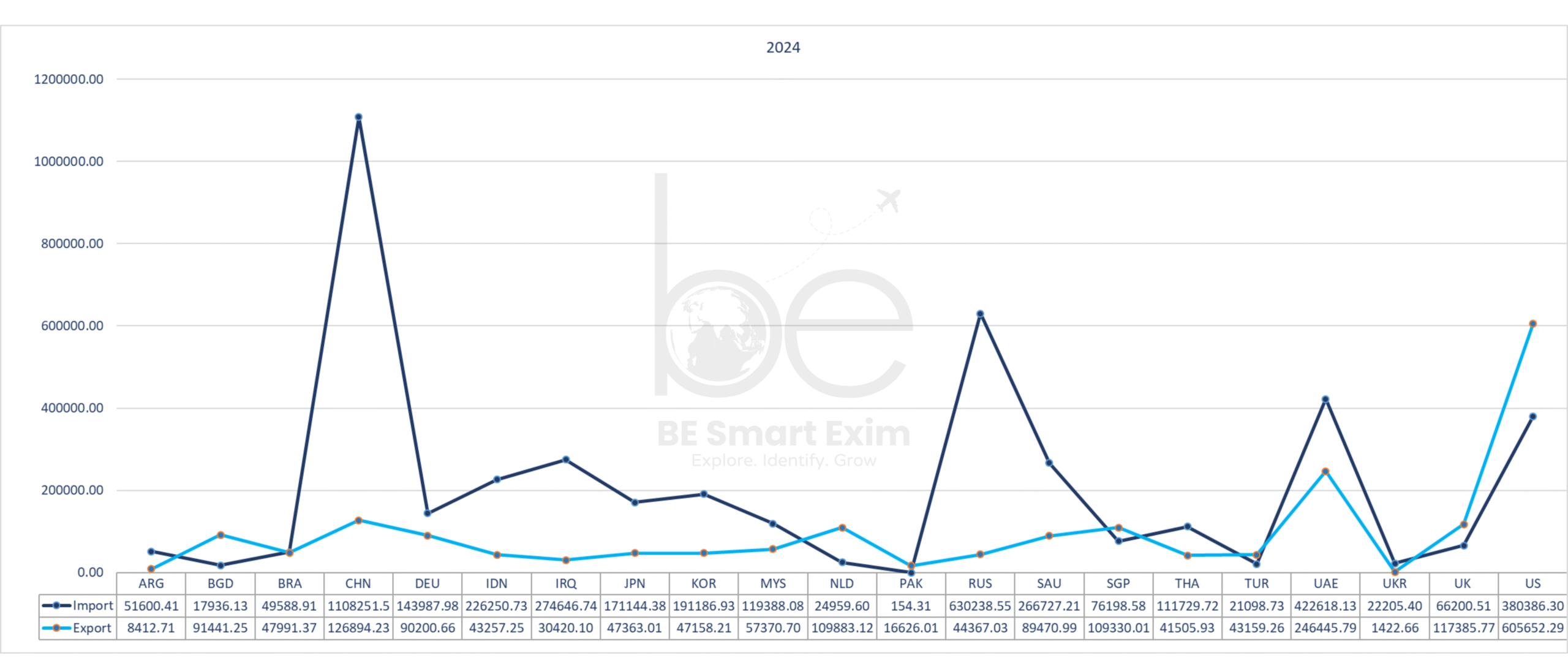

Quarterly Trends Reinforce Structural Patterns

This trend has been reinforced by the findings in the bar charts below. The import value from China has been consistently higher than 3.3-3.7 lakh crores per year, and that from Russia has been higher than 1.2-1.4 lakh crores per year, ruling out one-off instances of higher import value. Looking at exports, exports to the USA have been higher than 1.6-2.1 lakh crores per year.

India’s 2025 Exim Trends with Major Partners

India’s 2024 Exim Trends with Major Partners

These observations indicate that the deficits in India could be driven by its supply needs, and its balances could be backed by robust demand and various export bases.

Strategic Interpretation of the Numbers

Taken together, these figures show that the balance of trade deficit facing India is not even. The deficit-prone trade relationships indicate where India’s reliance on global factors and energy resources has to be supplemented, and, conversely, these trade relationships also indicate where improvements can be made by developing Indian manufacturing, technology, and supply chain capabilities. The surplus trade relationships, on the other hand, indicate where India has already secured scale and market power.

These statistics highlight the fact that the data indicate an economy in transition—one that balances the required imports with a steady improvement in the position it holds as a value-adding exporter. This set of numbers is essential in understanding the movement in the economic trends for a country and a quarter.

The balance of trade position of India in the year 2025 is indicative of both its structural requirements and rising capabilities. The presence of large deficits with important trading partners indicates the requirement for supply diversification, whereas the consistent presence of surpluses indicates the increasing scale and acceptance of Indian products in the global marketplace. Thus, trade deficits and surpluses indicate areas where strategic interventions must be made.

Part 2 of this series would further look into the markets for the trade deficits that India has, and Part 3 would look deeper into the markets that are contributing to India’s balance of exports.