Every autumn, India lights up with festivals. Durga Puja, Navratri, Dussehra, Chhath Puja, Kali Puja, Jagadhatri Puja, and Diwali mark this lively season. These events are not just cultural celebrations; they also serve as economic milestones. The season prompts a rise in international trade. This influx of exports and imports directly influences how India engages with global markets like the US, China, the Middle East, and others. Products such as jewelry, ethnic clothing, sweets, idols, diyas, lights, and even Hilsa fish see significant demand. The festive calendar translates directly into trade activity. In this blog, we examined these sectors. The data behind them came alive through beDATOS, which helped illustrate the changing patterns of India’s festive commerce.

Jewellery and Festive Investments

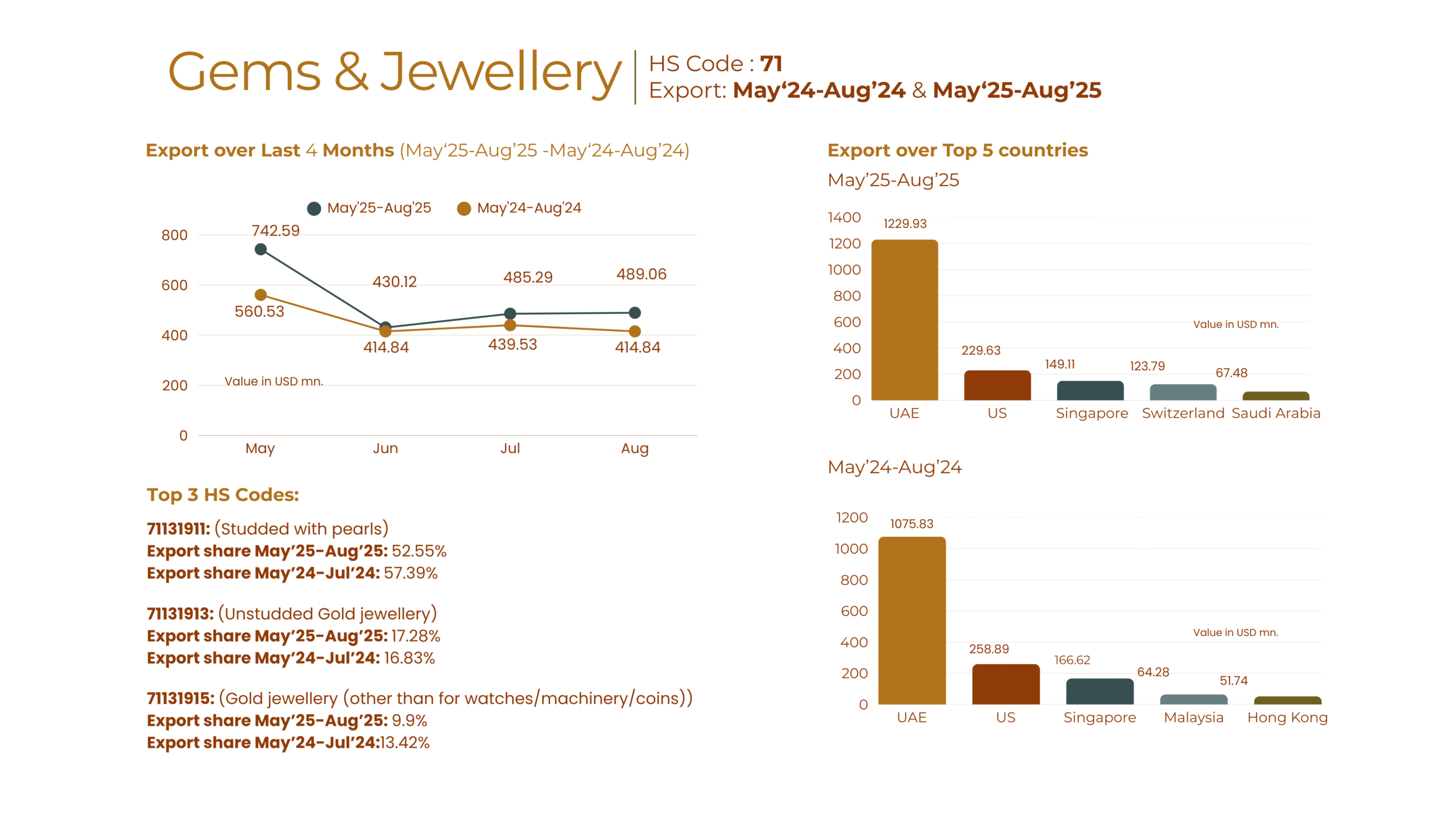

The gems and jewellery sector is one of India’s most dependable festive exports. The latest export data shows that shipments between May and August 2025 reached USD 742.59 million in May, then stabilized at USD 489.06 million in August. This is an increase from USD 560.53 million in May 2024, indicating a strong demand at the start of the season.

Much of this demand comes from global hotspots. The UAE alone imported USD 1.22 billion worth of goods from India between May and August 2025. The US followed with USD 229.63 million, and Singapore also contributed.

The product mix also tells a story. Jewellery studded with pearls accounted for 52.55% of export share in 2025, down from 57.39% last year. Unstudded gold jewellery made up 17.28%. As festivals approach, jewellery is not just decorative. It serves as both an investment and a tradition, boosting international demand, especially during Diwali and Dussehra.

Fashion and Ethnic Wear on the Global Stage

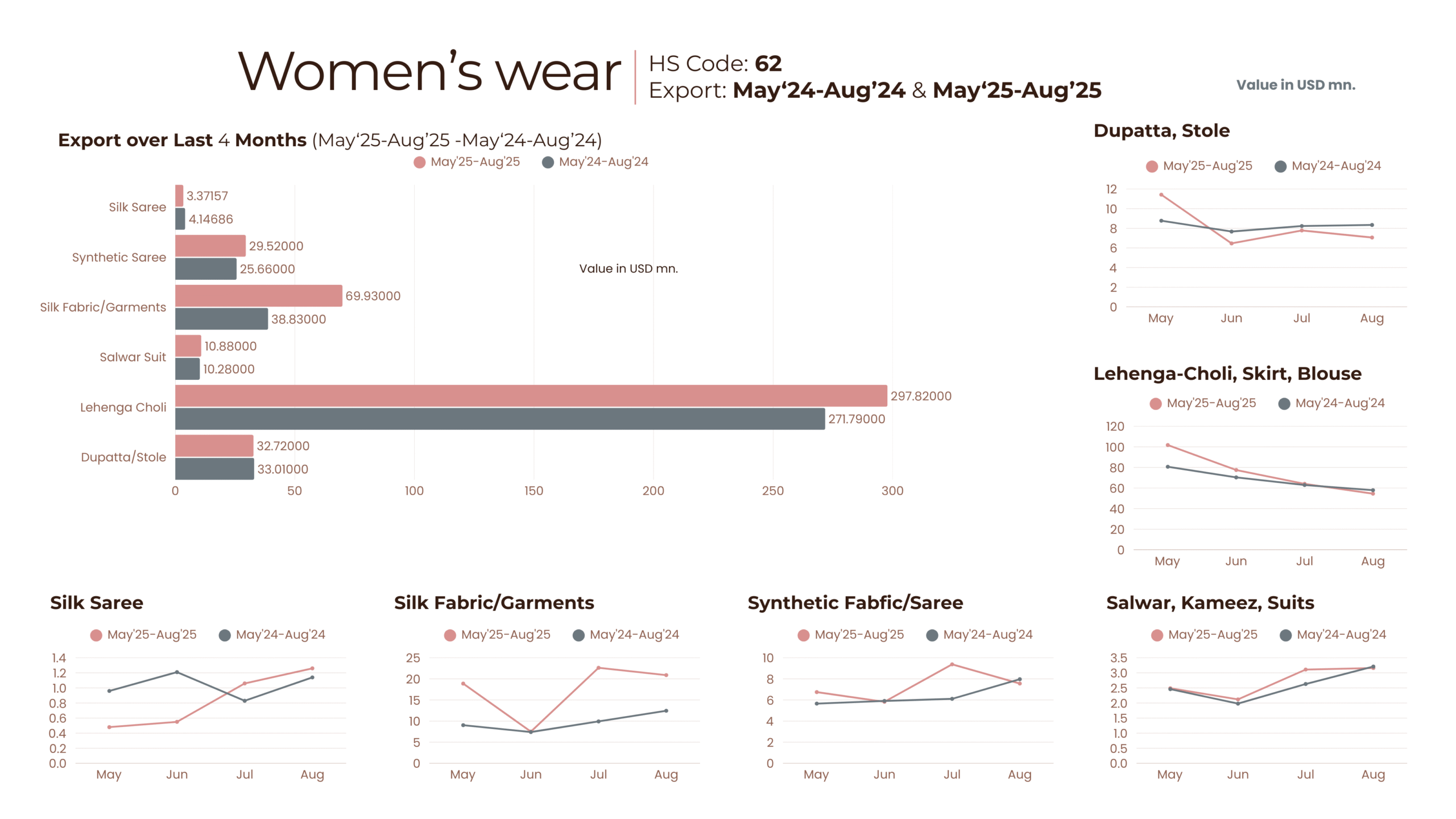

Indian festivals are closely linked to new wardrobes, including sarees, lehengas, kurtas, and dupattas. The women’s wear segment alone reported exports of USD 297.82 million for lehengas and cholis from May to August 2025. This marked an increase from USD 271.79 million during the same period last year.

India imports a large quantity of raw textiles from China and Bangladesh. Its silk fabric and garments also increased, reaching USD 69.93 million in exports this season compared to USD 38.83 million last year. This shows a rising global demand for quality Indian textiles.

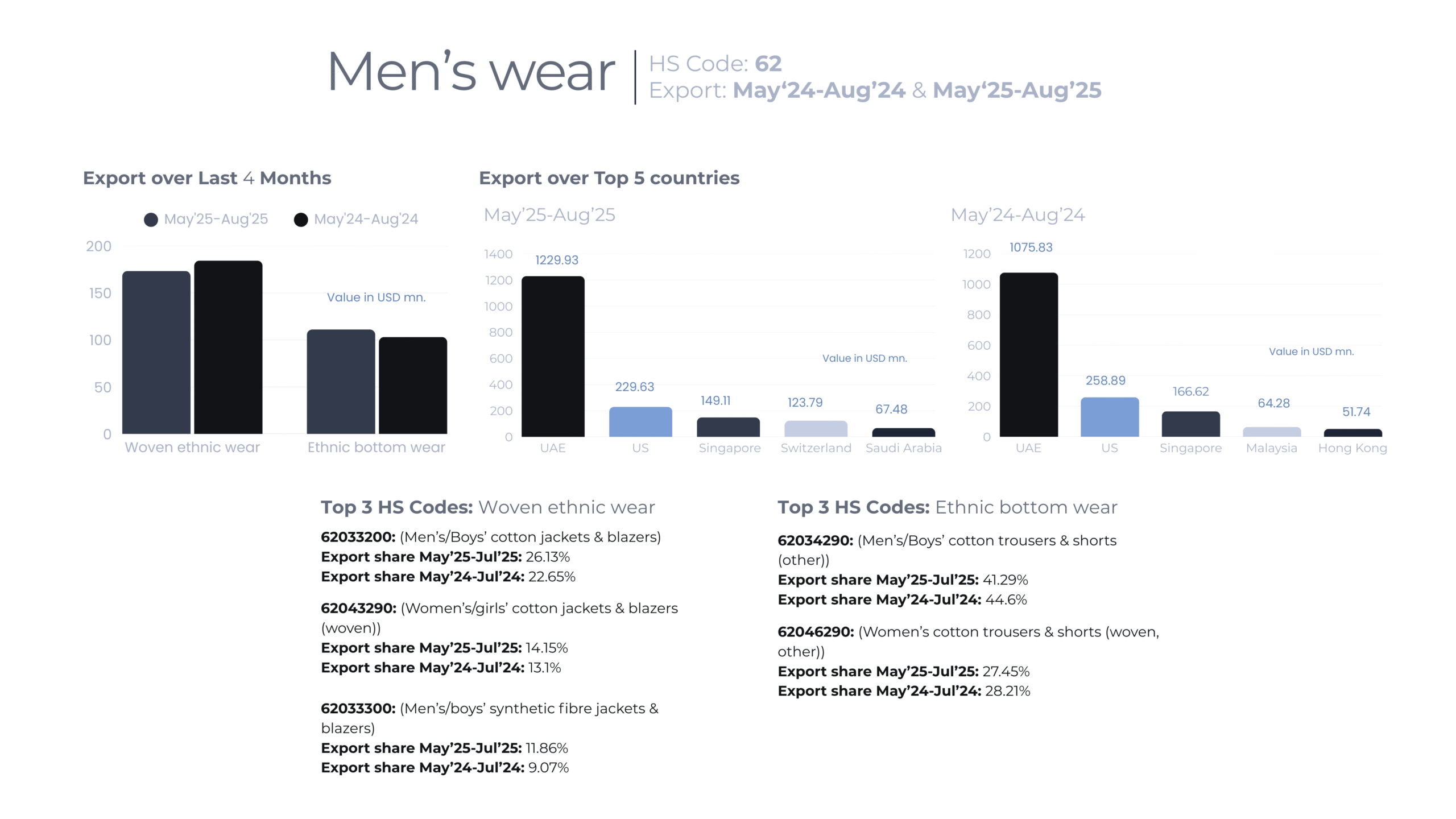

On the men’s side, exports of woven ethnic wear reached USD 172.93 million between May and August 2025. This is a slight decrease from last year’s peak, but still strong. The UAE (USD 1.22 billion), US (USD 229.63 million), and Singapore remain the top destinations.

While exports are increasing, India’s apparel industry also depends on imports of fabrics, sequins, and accessories from China to meet festive deadlines. This highlights the dual nature of festive trade; it acts as both an exporter of finished products and an importer of essential raw materials.

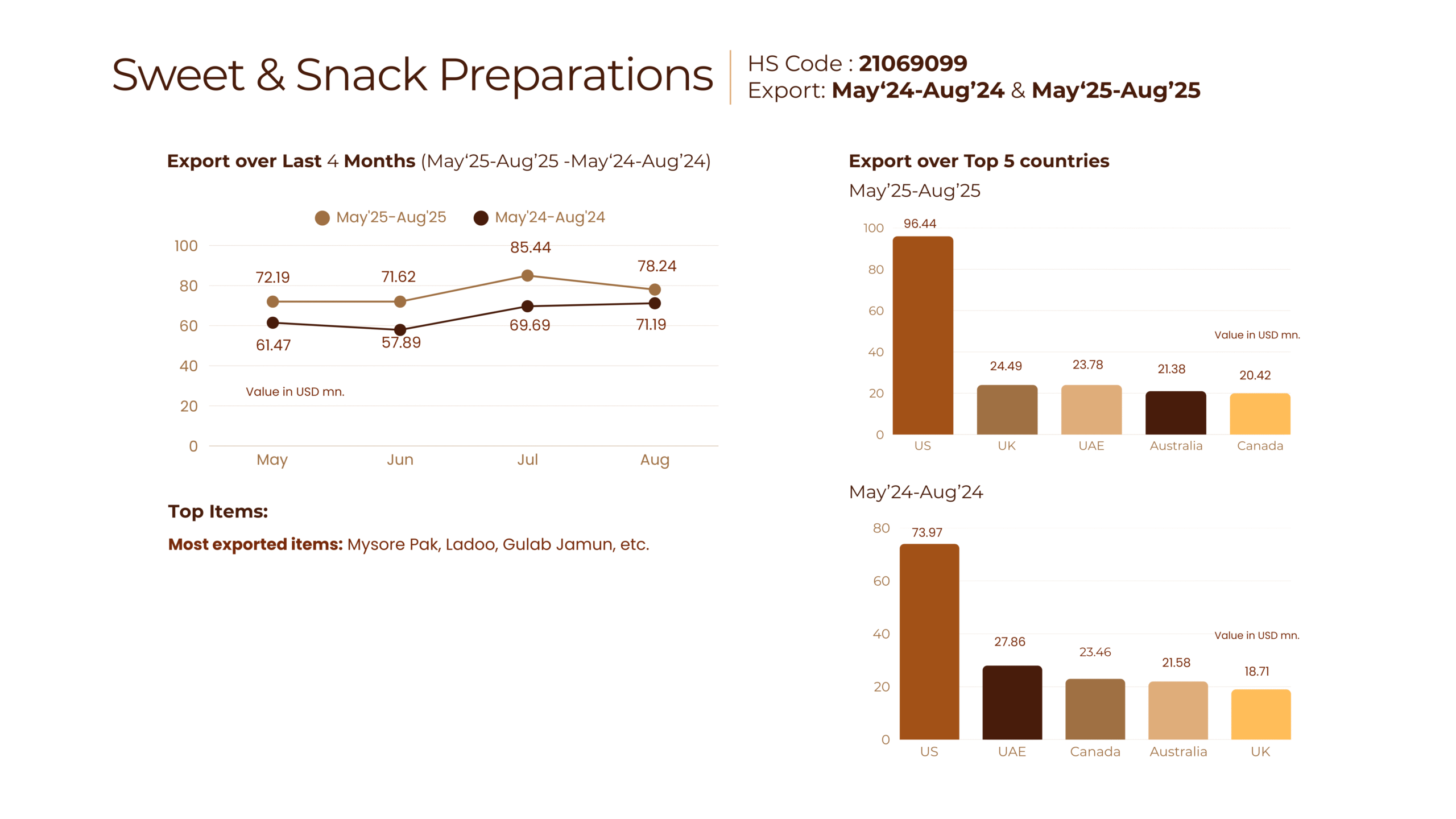

The Sweet Taste of Exports

Festive sweets are more than just treats; they play a role in the economy. The latest export data for Sweet & Snack Preparations (HS 21069099) shows a clear rise in demand during the festival season. Between May and August 2025, exports grew from USD 72.19 million in May to USD 85.44 million in July, then dipped slightly to USD 78.24 million in August. This marks a significant increase compared to the same months in 2024, when exports ranged from USD 57.89 million to USD 73.97 million.

The US is still the largest market, importing USD 96.44 million worth of Indian sweets in 2025. This is an increase from USD 73.97 million last year. Other major destinations include the UK at USD 24.49 million, the UAE at USD 23.78 million, Australia at USD 21.38 million, and Canada at USD 20.42 million. This shows not only the demand from the diaspora but also the rising global popularity of Indian mithai.

Among the most exported items are Mysore Pak, laddoo, and gulab jamun. These sweets travel across continents to reach festive tables. The export growth is closely linked to Navratri, Durga Puja, and Diwali, times when Indian families abroad stock up on traditional sweets.

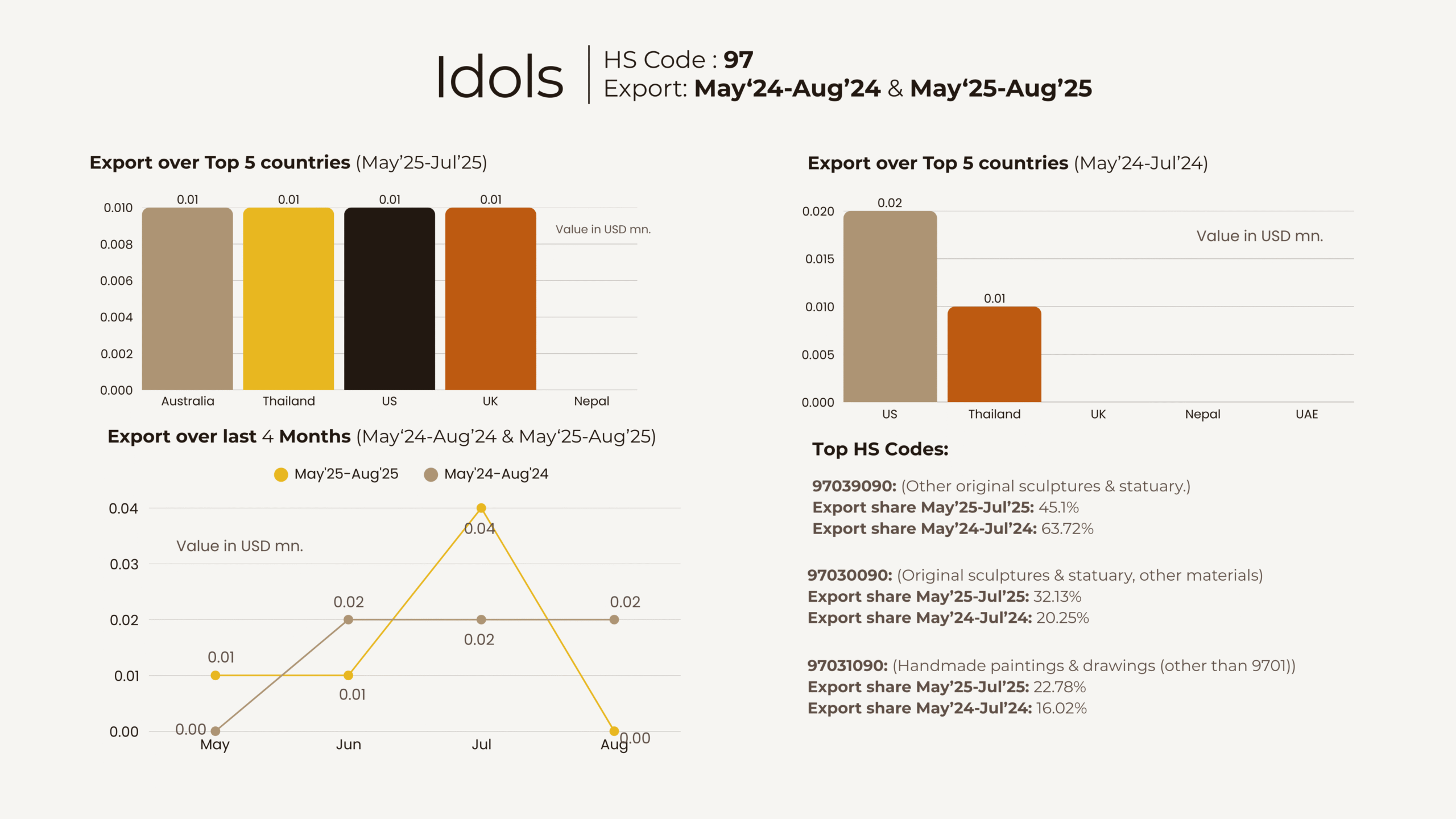

Idols as Cultural Exports

Idols of Ma Durga, Lord Ganesha, Ma Lakshmi, and Maha Kali are cultural symbols that reach well beyond India. Data shows that between May and July 2025, exports of idols were steady at USD 0.01 million across Australia, Thailand, the US, the UK, and Nepal, indicating diverse demand.

Year after year, the US has stayed the leading market, importing USD 0.02 million worth in 2024. However, the market shares are now more evenly spread. The top HS code, 97039090 (other original sculptures & statuary), accounted for 45.1% of idol exports in 2025, down from 63.72% last year. This shows greater variety in product categories.

Idol exports are more than just numbers; they represent cultural continuity. From Durga Puja pandals in New Jersey to Diwali celebrations in London, these artifacts connect communities abroad to their roots while supporting artisan livelihoods in India.

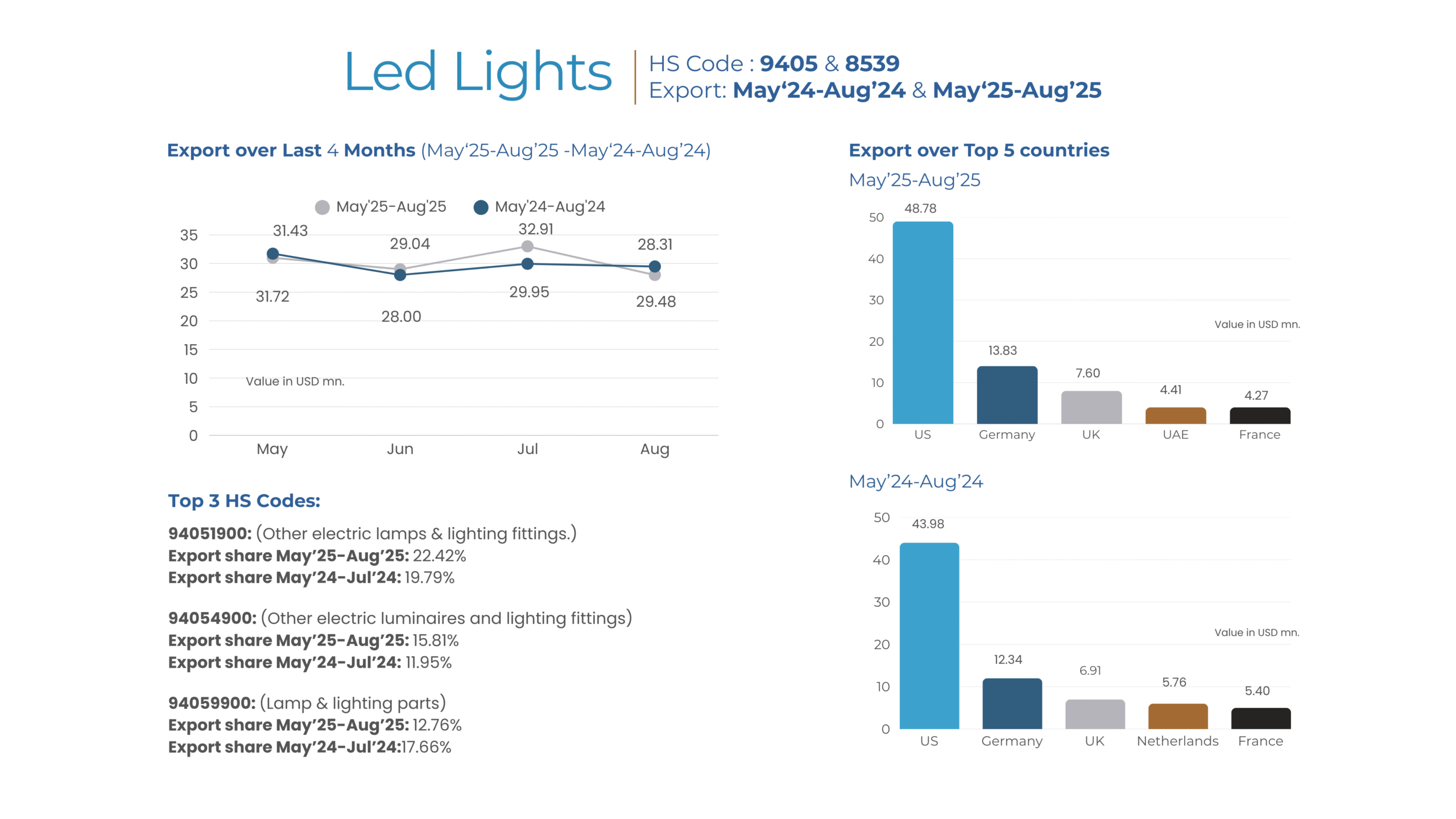

LEDs, Diyas, and the Festival of Lights

Diwali is known worldwide as the “Festival of Lights,” and the trade data supports this. Between May and August 2025, LED exports averaged USD 29 to 32 million each month. The US topped this with USD 48.78 million in imports, closely followed by Germany at USD 13.83 million.

The product mix includes electric lamps (HS 94051900), which alone represented 22.42% of export share in 2025, up from 19.79% last year. This reflects a blend of technology and tradition as they evolve into modernity.

India is also a major importer of LED products, especially components and raw materials that are later reassembled or customized domestically for festive markets. From May to August 2025, LED imports exceeded USD 46.68 million in May, increased to USD 54.62 million in July, and reached USD 51.18 million in August. [Insert chart: LED Imports]. Most of these imports came from China, which held a 67.38% market share (USD 1.32 billion) during this period. Germany followed with USD 131.5 million, and the US with USD 97.17 million. This highlights India’s role in the LED trade as both a supplier of festive-ready lights for export and a buyer of core technology from other countries.

Yet alongside LEDs, traditional clay diyas still cross borders, holding significant cultural value. The export data for diyas from May 2024 to August 2025 reveals shipments worth USD 38.3k in 2024 and USD 33.3k in 2025. This shows that, although a small niche compared to LEDs, diyas remain strong in global trade.

The top destinations for diya exports in 2025 (May to August) included the US, leading with USD 8.46k (25.43% share), closely followed by Mauritius with USD 7.7k (23.16%) and Australia with USD 7.18k (21.59%). This indicates that diaspora communities across Africa, Oceania, and North America continue to import diyas for festive use.

In short, while LEDs define modern festive décor, diyas keep tradition alive. The trade data demonstrates that India uniquely balances modern imports and exports with traditional exports, creating a festive trade basket unlike any other in the world.

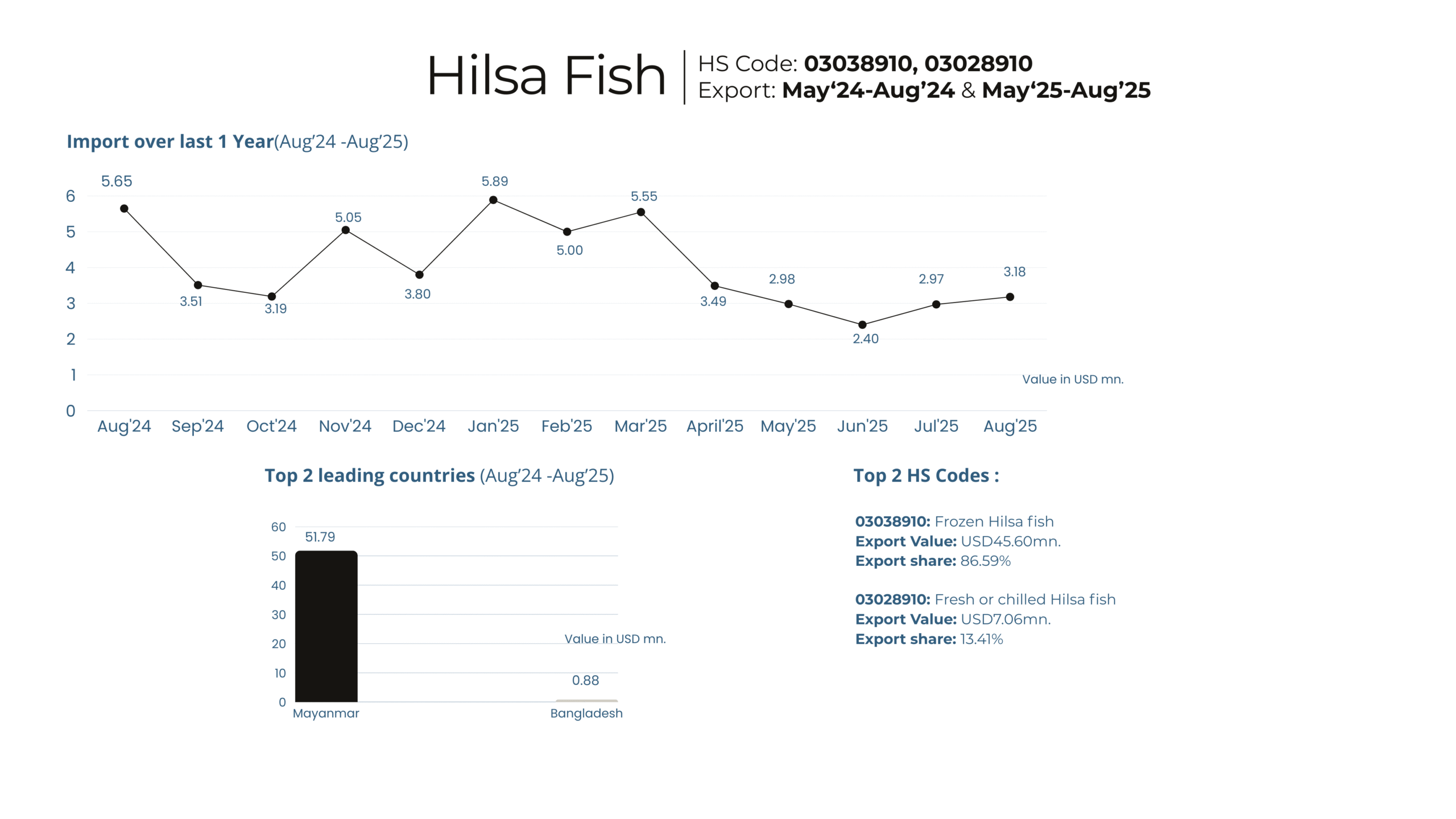

Hilsa and the Culinary Connection

No festive table in Bengal is complete without Hilsa fish, especially during Durga Puja. Traditionally, India imported most of its Hilsa from Bangladesh. However, new data shows a change: between August 2024 and August 2025, Myanmar exported Hilsa worth USD 51.79 million, far surpassing Bangladesh’s USD 0.88 million.

This reversal might be connected to the political changes in Bangladesh last year, which likely affected trade permissions and supply chains. Frozen Hilsa (HS 03038910) accounted for 86.59% of exports, while fresh Hilsa made up 13.41%. This trend highlights how cultural preferences, such as Durga Puja feasts, intersect with geopolitical realities and change import flows into India.

Tracking India’s Trade Pulse

Festivals bring joy, but they also show how cultures and economies connect. The increase in exports and imports during Durga Puja, Navratri, Diwali, and other celebrations highlights India’s role in blending tradition with global trade. Products like jewellery, ethnic wear, sweets, idols, fish, and diyas each hold cultural meaning and economic importance.

Much of this story comes to life through beDATOS. It helped us understand the trade flows that shape the festive season. By combining various export and import data into one clear view, it offers a better understanding of how India’s celebrations influence international markets. To learn more about this, you can visit the beDATOS website.